Innovations in Agricultural Bio-Inputs: Commercial Products Developed in Argentina and Brazil

[ad_1]

1. Introduction

This study aims to characterize the state-of-the-art in commercial agricultural bio-input development that can lead developing countries to play an important global role in sustainable agriculture. Specifically, we aim to:

-

Summarize the innovations registered by governmental agencies for commercial use in Argentina and Brazil;

-

Characterize the commercial products made available in the market or under development by private companies;

-

Analyze the main market-related innovative pathways based on the products’ and companies’ characteristics.

2. Theoretical Framework

3. Methods

This study is based on official data on commercial bio-inputs and their active ingredients that are registered in Argentina and Brazil and on interviews with private companies that invest in research to develop new bio-inputs in these countries. The official data provided a comprehensive overview of the main technologies (extracts from live organisms or micro- and macro-organisms) used in both countries based on the products registered by private and public companies by January 2023. The interviews added information on the private companies’ new developments and perspectives for the future based on the products these companies were expecting to have on the market in the coming years.

Interviews were conducted in person in nine of the cases, and there were five interviews conducted by online video calls. Five of the in-person interviews included a visit to the company’s plant and lasted for around two hours, while the other interviews lasted for around one hour. The interviews were not recorded, and no personal information became available. The interviews covered the characteristics of the commercial products, their development process, and the products that were being registered or in the stage of field validation and are expected to be made available in the market in the coming years.

4. Results

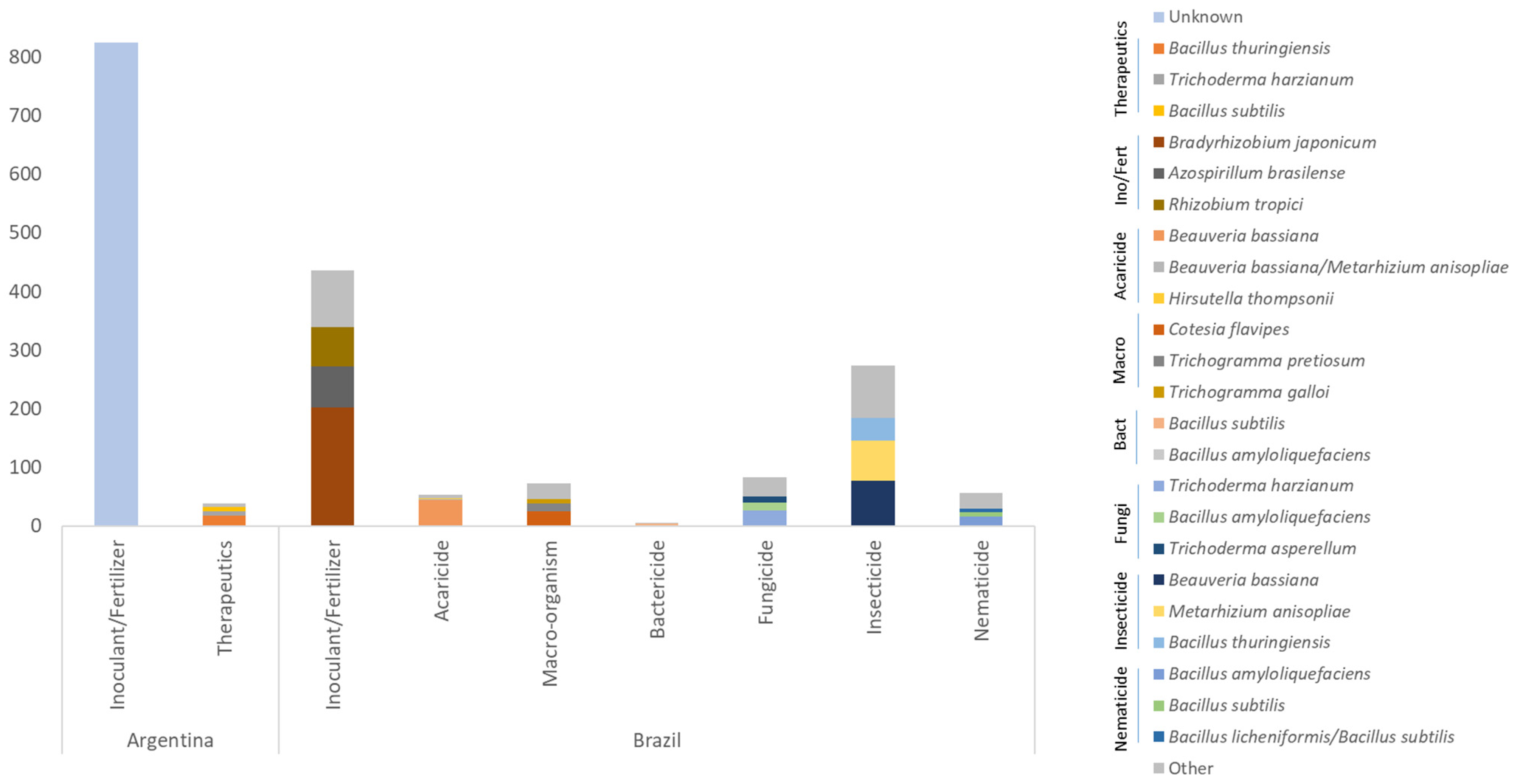

4.1. Products Registered by Governmental Agencies

Most of the products for plant therapeutics in Argentina were based on the bacteria Bacillus thuringiensis, but there were also products based on the fungus Trichoderma and one virus. Whereas the active ingredients for inoculants and bio-fertilizers were not made available by SENASA, the interviewed companies mentioned that their products are mostly based on bacteria such as Bradyrhizobium japonicum for inoculants and Bacillus subtilis and Pseudomonas fluorescens for bio-fertilizers.

Bio-pesticides (such as fungicides, insecticides, etc.) are registered in accordance with the Pesticides Law (lei 7802/89) in Brazil, but biological products can also be registered as inoculants or as phytosanitary products approved for use in organic agriculture. Since phytosanitary products approved for use in organic agriculture have low toxicity, their registration is faster than registration by the Pesticides Law.

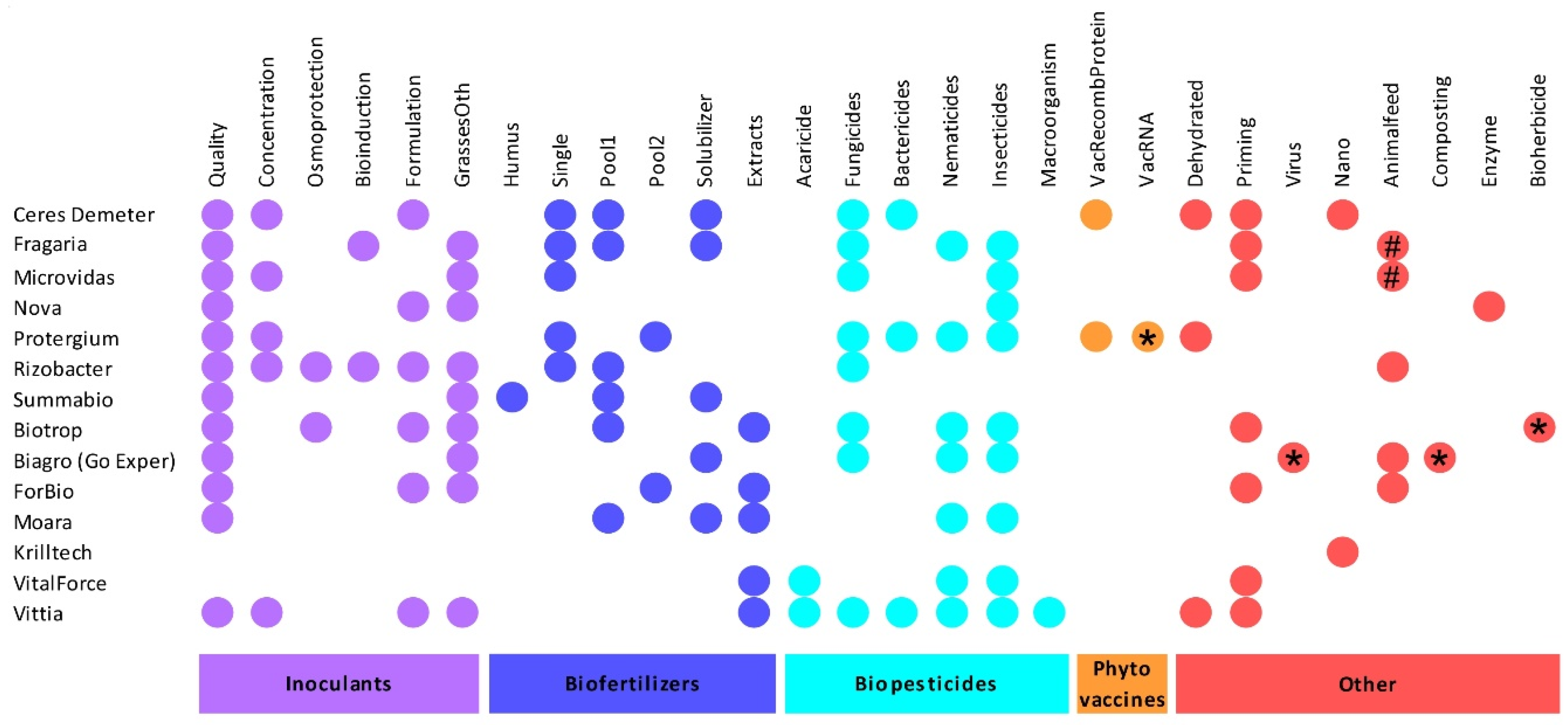

4.2. Developments Reported by Companies

4.2.1. More Efficient Inoculants

All but two interviewed companies have inoculants in their portfolio, and some are focused on developing more efficient inoculants given the size of their market. For example, the Argentinean Rizobacter is a global leader in inoculants for soybeans, and the company is also developing new products on the Rizoliq platform. Biagro (Go Exper) in Brazil also has important developments in inoculants, including Biagro N2 with Azospirillum brasilense for grasses and Biagro beans with Rhizobium tropici for beans. Almost all companies in Argentina use the Bradyrhizobium japonicum strain E109, isolated by the public agency INTA, and companies in Brazil also use strains isolated by different public agencies.

4.2.2. Bio-Fertilizers Made of a Pool of Organisms

An important recent commercial development in this segment was the use of soil-nutrient-solubilizing bacteria such as Pseudomonas fluorescens. Further developments resulted in pools of other organisms, such as Bacillus megaterium and Bacillus subtilis, that resulted in the leading phosphorous (P) solubilizer product in the Brazilian market. Innovation centers and companies continue working with different pools of organisms to solubilize different nutrients, such as potassium (K) and others.

Bio-extracts are another area for the development of bio-fertilizers, which include extracts of algae, amino acids, and biopolymers produced by the cells of living organisms and used to protect seeds and bacteria in inoculants. The Argentinean Ceres Demeter is registering Biopol P1 as a mix of natural polymers and sugars for coating peanut seeds, capable of protecting the shell and increasing the adherence and survival of growth-promoting microorganisms on it, improving fluidity compared to untreated seeds. In Brazil, Biotrop has Bionatus (based on extracts of the algae Ascophyllum nodosum) positioned in the market as a renewable biodegradable organo-mineral fertilizer; Forbio has Adiplus SojaFort NOD as a biopolymer to protect bacteria inoculated into soybean seeds; and Vital Force has Stimulus Root, which contains amino acids from algae.

All but two of the companies interviewed have bio-fertilizers in their portfolios, but some have a greater focus on bio-fertilizer development. For example, the Argentinean company Fragaria is now combining the bacteria Azospirillum brasiliense and Pseudomonas rhodesiae to prepare the fertilizer Acqua Duo, which is a PGPR bio-stimulator that solubilizes phosphorus. The Brazilian company Moara developed the product Bioprosolo using three species of Bacillus to solubilize P, stimulate root growth, and induce drought resistance. Go Exper is a leading company in P solubilization with a pool of Bacillus megaterium and Bacillus subtilis, developed in collaboration with Embrapa and registered as Biagro Energia by Biagro and BiomaPhos by Bioma.

4.2.3. Bio-Pesticide Formulations for Bio-Control

Commercial bio-control began with the use of some species of non-pathogenic fungi that control other species of pathogenic fungi. It then evolved to products combining different fungi and bacteria, resulting in products labeled on the market as bio-acaricides, bio-fungicides, bio-bactericides, bio-nematicides, and bio-insecticides. Ongoing developments are related to improving the long-term stability of the formulations, particularly those mixing bacteria and fungi. Such effort often implies having dedicated zones (or industrial plants) to work with microorganisms that produce spores, such as Bacillus and Trichoderma, and other zones to work with microorganisms that do not produce spores, as a means of preventing contamination by spores.

Developments in this sector also include isolating strains of new microorganisms to be used as bio-controls for different pathogenic organisms. For example, while the fungus Beauveria bassiana is well known by different companies, some companies invested in species of the genera Metarhizium (fungus) and Streptomyces (bacteria) to develop new fungicides. Formulations are also important to guarantee the quality of the product; while some companies use solid subtracts (such as rice), others multiply the microorganisms in liquid subtracts in bioreactors as a means of inducing the production of metabolites.

Macro-organisms are also deployed for bio-control in commercial products used as parasitoids or predators of insects and other pests. For example, Vittia has the product GALLOI-VIT (Trichogramma galloi), which is a biological control agent used to destroy the eggs of Diatraea saccharalis in sugar cane plantations. Companies are also beginning to work with viruses, and Biagro mentioned that the Go Exper holding is developing the virus-based product VirControl.

4.2.4. Phytovaccines as Molecules for Specific Targets

Applied biotechnology has allowed the development of active principles through the use of recombinant proteins, peptides, or RNA interference that can be used as phytovaccines to prepare the plants’ immune systems to resist the attack of pathogenic organisms such as fungi or bacteria. Recombinant proteins can promote efficient absorption of minerals and tolerance for stressful situations. The technique uses an isolated deoxyribonucleic acid (DNA) sequence from a pathogenic fungus or bacteria that is introduced in a bacteria or yeast that works as a factory to reproduce a target protein. Once the product is homogenized, the host bacteria are destroyed, and the resulting recombinant protein is used as an active ingredient for preparing bio-inputs. Similar biotechnology routes are used for peptides and ribonucleic acid (RNA), but the use of RNA interference requires encapsulating the molecule as a means of providing it with environmental stability. The resulting product is used as a bio-elicitor that activates the immune systems of the plants, playing the role of a phytovaccine.

The large-scale use of protein in pest control dates back to the application of Bacillus thuringiensis (BT) crystal protein to control lepidopterous larvae. Dating back to the 1920s, this innovation continued to be used as a commercial product even after the development of genetically modified BT corn. The phytovaccine differential is that it acts on the plant to prepare its immune system against potential pathogenic pests and does not act on the pests themselves.

4.2.5. Other Ongoing Developments

Interviewed companies are investing in a variety of new technologies, ranging from new products to new industrial processes, as summarized below.

-

Priming—Priming is the timely use of products to increase the plants’ capacity to resist biotic stress, such as fungi attack, and abiotic stress, such as drought. Different types of bio-inputs used at the right moment can have priming effects. The Argentinean companies Protergium and Ceres Demeter mentioned developing products to be used for priming. In Brazil, Vittia mentioned that its commercial fungicide and bactericide, Bio-Immune, based on Bacillus subtilis, has endospores that induce plant resistance. They also mentioned working with gene silencing in specific microorganisms.

-

Dehydrated products—Industrial processes such as lyophilization using low temperatures and sprays using heat are deployed to have solid/powder products (noted as wettable powder—WP) that reduce the costs of logistics. In Argentina, Fragaria uses lyophilization to prepare Biosilo, marketed under its own brand, and a probiotic produced for a third party. In Brazil, Biotrop uses lyophilization to prepare the insecticide Bioolimpo, sold as a powder-based product.

-

Virus—Insect viruses are disease-causing organisms that reproduce within a host insect and can control a variety of insects that attack crops. Biagro mentioned that the Go Exper holding is developing the product VirControl based on viruses.

-

Nanotechnology—Nanoparticles can be used as nanopesticides or nanofertilizers that enhance the capacity of plants to absorb nutrients. The Argentinean Ceres Demeter is developing a bio-input that includes microorganisms and organic nanoparticles, while the Brazilian Krilltech already has on the market the product Arbolina, which is based on organic carbon nanoparticles that function as physiological promoters.

-

Inoculants for livestock feeding—Bacteria can be used to improve the quality of livestock feeding. In Argentina, Fragaria has Biosilo on the market as an inoculant for silage made of lactic acid bacteria (Lactobacillus plantarum, Pediococcus acidilactici, and Lactobacillus buchneri) and cellulolytic enzymes, and Microvidas is developing products to be inoculated in cattle feed using bacteria of the genus Pseudomonas. The Brazilian Forbio is developing the product Forsilo made of Lactobacillus plantarum to accelerate the anaerobic fermentation of silage and improve the quality of the feed offered to cows.

-

Composting—Bio-inputs can be used to accelerate the process of bio-composting. Biagro mentioned isolating an inoculant for composting.

-

Enzymes—Enzymes are proteins that act as biological catalysts by accelerating chemical reactions. The Argentinean company Nova has an industrial plant dedicated to the production of enzymes, where they use different biological platforms to manufacture Xilanasa and Fitasa, which are enzymes used to improve digestion by monogastric livestock such as chickens and pigs (Table 3).

-

Bio-herbicides—Bio-herbicides can reduce the use of chemical herbicides to prepare fields for mechanical harvest. Biotrop mentioned developing a bio-herbicide for broad leaf weed in Brazil.

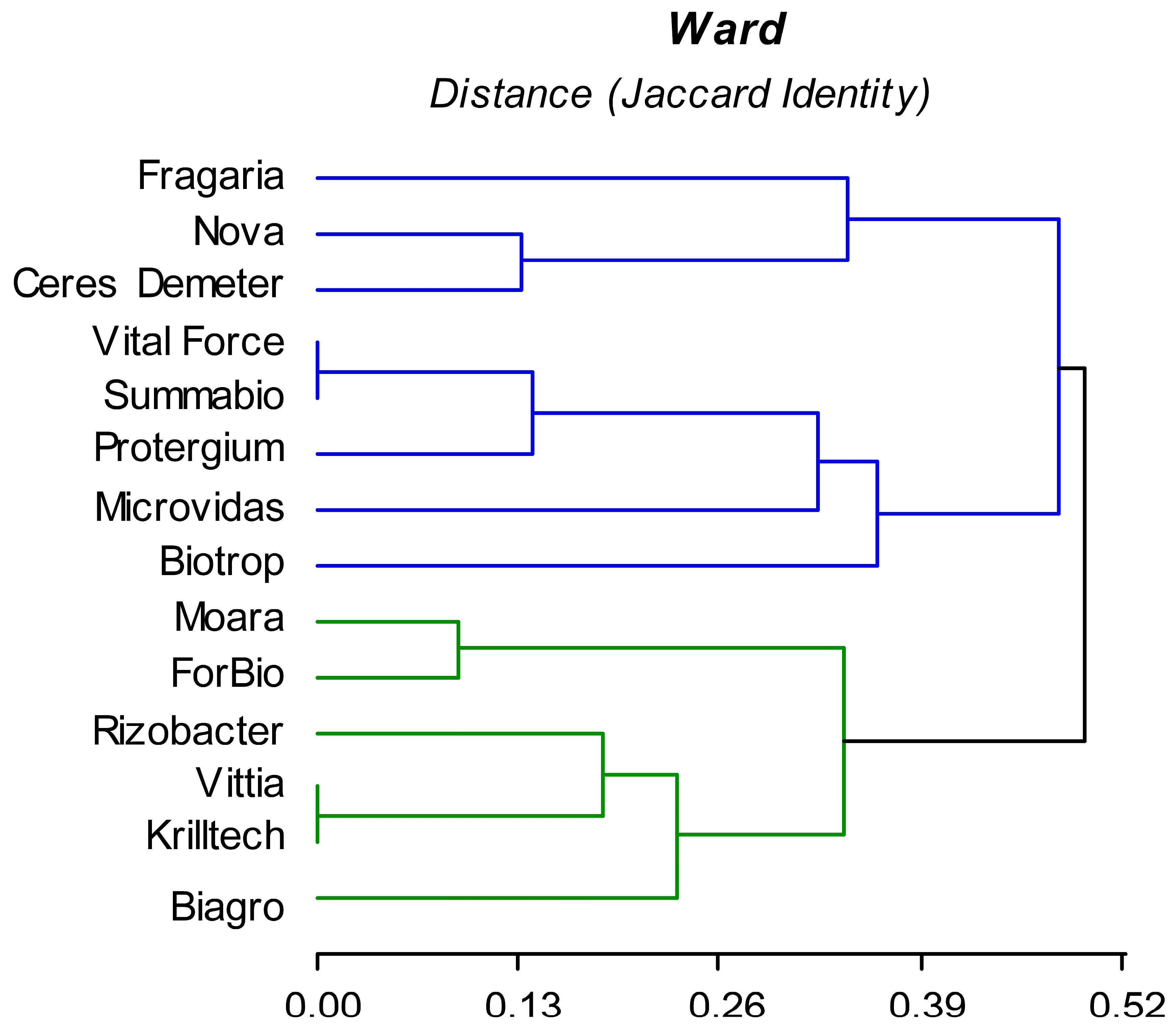

4.3. Innovation Pathways

-

Improving traditional products such as inoculants to compete in a large and consolidated market that has many competitors, small profit margins, but a large scale of sales. Some companies stand out in this sector, such as the Argentinean Rizobacter, which became a global leader in inoculants;

-

Mastering new products such as bio-pesticides and bio-fertilizers to meet growing demand from more exclusive markets that have large profit margins but are still niche markets in some cases. For example, while nematicides used in soybean fields are mostly biological (since biological products are often more effective than chemical products to control nematodes), bio-insecticides are often used alongside chemical products to reduce the number of applications of chemical products. Targeting this market, the Brazilian company Vittia specialized itself in bio-pesticides based on micro- and macro-organisms.

-

Developing innovations to conquer new and more exclusive technology-based markets by meeting existing demands for specific products. The Argentinean Protergium stands out in the segment of phytovaccines with two products based on recombinant proteins that are being registered.

5. Discussion

The limitations of this study include the relatively small number of companies interviewed. Despite the importance of the bio-inputs sector in Argentina and Brazil, there are still no country-wide updated sources of information on the main sector trends that can guide assertive investments in product development and market expansion. Key market-related missing information includes:

-

Main public innovation centers—List of the main research teams alongside the most important research centers (organizations/laboratories/researchers) and their recent developments on bio-inputs. This information is available for Argentina [24], but not for Brazil;

-

Companies with commercial products—Description of companies with products registered and technologies currently available and under development (with their technology readiness levels—TRL);

-

Bio-inputs market—Survey of the volume and values sold by type or group of products (such as bionematicides) and regions;

-

Current adoption by farmers—Interview with a sample of farmers nationwide on adoption levels;

-

Potential adoption by farmers—In-depth survey with farmers in a region where there are high adoption levels to identify the ideal/possible level of adoption per crop given the existing solutions in bio-inputs;

-

On-farm adoption by farmers—Assessment of the on-farm production (on-farm bio-factories) sector, including its size (number of companies), distribution (by state), and adopting farmers’ profiles.

6. Conclusions

The results of this study reveal ongoing development efforts to improve traditional agricultural bio-inputs such as inoculants, to master the formulation of new products such as bio-fertilizers and bio-pesticides, and to develop the next generation of bio-inputs such as phytovaccines and bio-herbicides. Private companies, in collaboration with public research centers, are leading innovations on these different fronts by targeting different market opportunities with potential for important contributions in terms of bio-economy growth. Taken together, these developments already provide more efficient commercial inoculants to improve the biological fixation of nitrogen in soybeans, as well as new inoculants for cereals such as wheat and corn and in fruits and vegetables. Bio-fertilizers made of pools of microorganisms resulted in commercial products to induce plant growth and solubilize soil nutrients. Bio-pesticides are also available on the market as bio-acaricides, bio-fungicides, bio-bactericides, bio-nematicides, and bio-insecticides.

Ongoing developments promise the next generation of agricultural bio-inputs, such as phytovaccines to activate the plant’s immune system and bio-herbicides to potentially replace synthetic chemical herbicides in preparing fields to be harvested. The use of industrial processes such as lyophilization also allows the formulation of powder instead of liquid commercial products, which reduces the logistical costs.

Domestic stakeholders have an important role in these technological developments. The official records show that both foreign multinationals and domestic private companies lead in the number of products registered in Argentina and Brazil. The survey conducted with the domestic companies reveals their leading role in the different innovation fronts described in this study that can lead companies in Argentina and Brazil to establish themselves in the global market for agricultural bio-inputs.

Potentially disruptive innovations such as bio-herbicides, phytovaccines, and isolated metabolites extracted from microorganisms can underpin bio-economy growth globally. The sector of agricultural bio-inputs can be seen as an opportunity for developing countries to go beyond the primary production of agricultural commodities and build new agro-industrial capabilities for sustained agro-industrial growth.

Author Contributions

G.d.S.M.—Conceptualization; Data curation; Formal analysis; Funding acquisition; Investigation; Methodology; Validation; Visualization; Writing—original draft; Writing—review and editing. R.R.—Conceptualization; Formal analysis; Investigation; Methodology; Supervision. G.R.R.—Conceptualization; Formal analysis; Investigation; Methodology; Software; Supervision; Writing—review and editing. All authors have read and agreed to the published version of the manuscript.

Funding

This research received external funding from the Fundação de Apoio à Pesquisa do Distrito Federal (FAPDF), call DPG/UnB Nº 0004/2022, Programa de Bolsas de Pós-Doutorado no Exterior/FAPDF.

Institutional Review Board Statement

Not applicable since interviewees were informed that the interviews would not be recorded nor their names would be made available. All interviewees provided informed consent when taking part in the survey, following Argentina’s and Brazil’s ethics protocols for research with human beings.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

The data presented in this study are available on request.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Jacquet, F.; Jeuffroy, M.-H.; Jouan, J.; Le Cadre, E.; Litrico, I.; Malausa, T.; Reboud, X.; Huyghe, C. Pesticide-free agriculture as a new paradigm for research. Agron. Sustain. Dev. 2022, 42, 8. [Google Scholar] [CrossRef]

- Bierbaum, R.; Leonard, S.A.; Rejeski, D.; Whaley, C.; Barra, R.O.; Libre, C. Novel entities and technologies: Environmental benefits and risks. Environ. Sci. Policy 2020, 105, 134–143. [Google Scholar] [CrossRef]

- Palmisano, T. Narratives and practices of pesticide removal in the Andean valleys of Chile and Argentina. Environ. Sci. Policy 2023, 139, 149–156. [Google Scholar] [CrossRef]

- Kaushik, B.; Kumar, D.; Shamim, M. Biofertilizers and Biopesticides in Sustainable Agriculture; Apple Academic Press: New York, NY, USA, 2019. [Google Scholar] [CrossRef]

- Forbes Agro. O Mercado de Bioinsumos. Available online: https://forbes.com.br/forbesagro/2023/01/o-mercado-de-bioinsumos-vai-para-onde-no-brasil/ (accessed on 18 January 2023).

- Elnahal, A.S.M.; El-Saadony, M.T.; Saad, A.M.; Desoky, E.-S.M.; El-Tahan, A.M.; Rady, M.M.; AbuQamar, S.F.; El-Tarabily, K.A. The use of microbial inoculants for biological control, plant growth promotion, and sustainable agriculture: A review. Eur. J. Plant Pathol. 2022, 162, 759–792. [Google Scholar] [CrossRef]

- Amaresan, N.; Sankaranarayanan, A.; Kumar, M.; Druzhinina, I. Advances in Trichoderma Biology for Agricultural Applications; Springer International Publishing: Berlin/Heidelberg, Germany, 2022. [Google Scholar] [CrossRef]

- Rojas, R.; Ávila, G.C.G.M.; Contreras, J.A.V.; Aguilar, C.N. Biocontrol Systems and Plant Physiology in Modern Agriculture; Apple Academic Press: New York, NY, USA, 2022. [Google Scholar] [CrossRef]

- Mącik, M.; Gryta, A.; Frąc, M. Biofertilizers in agriculture: An overview on concepts, strategies and effects on soil microorganisms. Adv. Agron. 2020, 162, 31–87. [Google Scholar] [CrossRef]

- Kumar, Y. Nanofertilizers and their role in sustainable agriculture. Ann. Plant Soil Res. 2021, 23, 238–255. [Google Scholar] [CrossRef]

- Ke, J.; Wang, B.; Yoshikuni, Y. Microbiome Engineering: Synthetic Biology of Plant-Associated Microbiomes in Sustainable Agriculture. Trends Biotechnol. 2021, 39, 244–261. [Google Scholar] [CrossRef]

- Garcia, M.V.C.; Nogueira, M.A.; Hungria, M. Combining microorganisms in inoculants is agronomically important but industrially challenging: Case study of a composite inoculant containing Bradyrhizobium and Azospirillum for the soybean crop. AMB Express 2021, 11, 71. [Google Scholar] [CrossRef]

- Bercovich, B.A.; Villafañe, D.L.; Bianchi, J.S.; Taddia, C.; Gramajo, H.; Amalia Chiesa, M.; Rodríguez, E. Streptomyces eurocidicus promotes soybean growth and protects it from fungal infections. Biol. Control 2022, 165, 104821. [Google Scholar] [CrossRef]

- Martins, S.J.; Pasche, J.M.; Silva, H.A.; Selten, G.G.; Savastano, N.; Abreu, L.; Bais, H.; Garrett, K.A.; Kraisitudomsook, N.; Pieterse, C.M.J.; et al. The Use of Synthetic Microbial Communities (SynComs) to Improve Plant Health. Phytopathology 2023, 113, 1369–1379. [Google Scholar] [CrossRef]

- Patil, S.V.; Borase, H.P.; Salunkhe, J.D.; Suryawanshi, R.K. Isolation and Screening of Zinc Solubilizing Microbes: As Essential Micronutrient Bio-Inputs for Crops. In Practical Handbook on Agricultural Microbiology; Springer Protocols Handbooks; Springer: Berlin/Heidelberg, Germany, 2022; pp. 181–186. [Google Scholar] [CrossRef]

- Hakim, S.; Naqqash, T.; Nawaz, M.S.; Laraib, I.; Siddique, M.J.; Zia, R.; Mirza, M.S.; Imran, A. Rhizosphere Engineering With Plant Growth-Promoting Microorganisms for Agriculture and Ecological Sustainability. Front. Sustain. Food Syst. 2021, 5, 617157. [Google Scholar] [CrossRef]

- Polack, L.A.; Lecuona, R.E.; López, S.N. Control Biológico de Plagas en Horticultura: Experiencias Argentinas de Las Últimas Tres Décadas; Ediciones INTA: Buenos Aires, Argentina, 2020. [Google Scholar]

- Sarkar, D.; Singh, S.; Parihar, M.; Rakshit, A. Seed bio-priming with microbial inoculants: A tailored approach towards improved crop performance, nutritional security, and agricultural sustainability for smallholder farmers. Curr. Res. Environ. Sustain. 2021, 3, 100093. [Google Scholar] [CrossRef]

- Pouresmaeil, M.; Sabzi-Nojadeh, M.; Movafeghi, A.; Aghbash, B.N.; Kosari-Nasab, M.; Zengin, G.; Maggi, F. Phytotoxic activity of Moldavian dragonhead (Dracocephalum moldavica L.) essential oil and its possible use as bio-herbicide. Process Biochem. 2022, 114, 86–92. [Google Scholar] [CrossRef]

- Hodson de Jaramillo, E.; Trigo, E.J.; Campos, R. The Role of Science, Technology and Innovation for Transforming Food Systems in Latin America and the Caribbean. In Science and Innovations for Food Systems Transformation; Springer International Publishing: Cham, Switzerland, 2023; pp. 737–749. [Google Scholar] [CrossRef]

- Medina, G.d.S.; Rotondo, R.; Rodríguez, G.R. Agricultural Bio-Inputs as an Innovative Area of Opportunity for Agro-Industrial Growth in Developing Countries: Lessons from Argentina. World 2023, 4, 709–725. [Google Scholar] [CrossRef]

- Goulet, F.; Hubert, M. Making a Place for Alternative Technologies: The Case of Agricultural Bio-Inputs in Argentina. Rev. Policy Res. 2020, 37, 535–555. [Google Scholar] [CrossRef]

- Meyer, M.; Bueno, A.; Mazaro, S.; Silva, J. Bioinsumos na Cultura da Soja; Embrapa Soja: Londrina, Brazil, 2022. [Google Scholar]

- Starobinsky, G.; Monzón, J.; Broggi, E.; Braude, H. Bioinsumos para la Agricultura Que Demandan Esfuerzos de Investigación y Desarrollo, 1st ed.; Ministerio de Desarrollo Productivo Argentina: Buenos Aires, Argentina, 2021.

- Laibach, N.; Börner, J.; Bröring, S. Exploring the future of the bioeconomy: An expert-based scoping study examining key enabling technology fields with potential to foster the transition toward a bio-based economy. Technol. Soc. 2019, 58, 101118. [Google Scholar] [CrossRef]

- Keswani, C.; Dilnashin, H.; Birla, H.; Singh, S.P. Obstacles in the Adaptation of Biopesticides in India. In Bio#Futures; Springer International Publishing: Cham, Switzerland, 2021; pp. 301–318. [Google Scholar] [CrossRef]

- Oguntuase, O.J. Advancing a Framework for Entrepreneurship Development in a Bioeconomy. In Handbook of Research on Nascent Entrepreneurship and Creating New Ventures; IGI Global: Hershey, PA, USA, 2021; pp. 295–315. [Google Scholar] [CrossRef]

- Das, S.; Ray, M.K.; Panday, D.; Mishra, P.K. Role of biotechnology in creating sustainable agriculture. PLoS Sustain. Transform. 2023, 2, e0000069. [Google Scholar] [CrossRef]

- Ayilara, M.S.; Adeleke, B.S.; Babalola, O.O. Bioprospecting and Challenges of Plant Microbiome Research for Sustainable Agriculture, a Review on Soybean Endophytic Bacteria. Microb. Ecol. 2023, 85, 1113–1135. [Google Scholar] [CrossRef]

- Goulet, F. Characterizing alignments in socio-technical transitions. Lessons from agricultural bio-inputs in Brazil. Technol. Soc. 2021, 65, 101580. [Google Scholar] [CrossRef]

- Cruz, J.E.; Medina, G.d.S.; Júnior, J.R.d.O. Brazil’s Agribusiness Economic Miracle: Exploring Food Supply Chain Transformations for Promoting Win–Win Investments. Logistics 2022, 6, 23. [Google Scholar] [CrossRef]

- OECD. The Measurement of Scientific, Technological and Innovation Activities. In Oslo Manual 2018; OECD: Paris, France, 2018. [Google Scholar] [CrossRef]

- Leonardi, V.; García Casal, I.; Cristiano, G. Desempeño innovador de un grupo de Mipymes agroindustriales argentinas. Econ. Soc. 2009, 14, 45–64. [Google Scholar]

- Sili, M.; Dürr, J. Bioeconomic Entrepreneurship and Key Factors of Development: Lessons from Argentina. Sustainability 2022, 14, 2447. [Google Scholar] [CrossRef]

- Tessarin, M.; Suzigan, W.; Guilhoto, J.J.M. Cooperação para inovar no Brasil: Diferenças segundo a intensidade tecnológica e a origem do capital das empresas. Estud. Econ. 2020, 50, 671–704. [Google Scholar] [CrossRef]

- Morceiro, P.C.; Tessarin, M.S.; Guilhoto, J.J.M. Produção e uso setorial de tecnologia no Brasil. Econ. Apl. 2022, 26. [Google Scholar]

- OECD. Agricultural Policy Monitoring and Evaluation. In Agricultural Policy Monitoring and Evaluation 2022; OECD: Paris, France, 2022. [Google Scholar] [CrossRef]

- Rana, S.; Kapoor, S.; Rana, A.; Dhaliwal, Y.S.; Bhushan, S. Industrial Apple Pomace as a Bioresource for Food and Agro Industries. In Sustainable Agriculture Reviews 56; Springer: Cham, Switzerland, 2021; pp. 39–65. [Google Scholar] [CrossRef]

- Ekielski, A.; Żelaziński, T.; Mishra, P.K.; Skudlarski, J. Properties of Biocomposites Produced with Thermoplastic Starch and Digestate: Physicochemical and Mechanical Characteristics. Materials 2021, 14, 6092. [Google Scholar] [CrossRef]

- Senasa. Registro de Productos Fertilizantes, Enmiendas y Otros. Servicio Nacional de Sanidad y Calidad Agroalimentaria—Dirección de Tecnología de la Información. Available online: https://aps2.senasa.gov.ar/vademecumFertilizantes/app/publico (accessed on 18 January 2023).

- Senasa. Registro Nacional de Terapéutica Vegetal. Servicio Nacional de Sanidad y Calidad Agroalimentaria—Dirección de Tecnología de la Información. Available online: https://aps2.senasa.gov.ar/vademecum/app/publico/formulados (accessed on 18 January 2023).

- MAPA. Agrofit—Sistema de Agrotóxicos Fitossanitários. MAPA (Ministério da Agricultura Pecuária e Abastecimento). Available online: https://agrofit.agricultura.gov.br/agrofit_cons/principal_agrofit_cons (accessed on 17 January 2023).

- Petrovan, S.O.; Aldridge, D.C.; Bartlett, H.; Bladon, A.J.; Booth, H.; Broad, S.; Broom, D.M.; Burgess, N.D.; Cleaveland, S.; Cunningham, A.A.; et al. Post COVID-19: A solution scan of options for preventing future zoonotic epidemics. Biol. Rev. 2021, 96, 2694–2715. [Google Scholar] [CrossRef]

- Orr, A.; Ahmad, B.; Alam, U.; Appadurai, A.; Bharucha, Z.P.; Biemans, H.; Bolch, T.; Chaulagain, N.P.; Dhaubanjar, S.; Dimri, A.P.; et al. Knowledge Priorities on Climate Change and Water in the Upper Indus Basin: A Horizon Scanning Exercise to Identify the Top 100 Research Questions in Social and Natural Sciences. Earth’s Futur. 2022, 10, e2021EF002619. [Google Scholar] [CrossRef]

- Di Rienzo, J.A.; Casanoves, F.; Balzarini, M.G.; Gonzalez, L.; Tablada, M.; Robledo, C. INFOSTAT Version 2011; Universidad Nacional de Córdoba: Córdoba, Spain, 2016. [Google Scholar]

Total number of products and the most common technologies (microorganisms) registered in Argentina and Brazil by January 2023. Source: Adapted from SENASA for Argentina and MAPA for Brazil [41,42]. Note: While Argentina registers products either as bio-fertilizers or plant therapeutics, Brazil registers bio-pesticides (or plant therapeutics) as acaricide, biological agent, bactericide, fungicide, insecticide, and nematicide.

Total number of products and the most common technologies (microorganisms) registered in Argentina and Brazil by January 2023. Source: Adapted from SENASA for Argentina and MAPA for Brazil [41,42]. Note: While Argentina registers products either as bio-fertilizers or plant therapeutics, Brazil registers bio-pesticides (or plant therapeutics) as acaricide, biological agent, bactericide, fungicide, insecticide, and nematicide.

Figure 2.

Number of cases of innovations in bio-inputs reported by the interviewed companies. Source: Interviews with companies’ representatives. Note: Innovations listed in the figure are available in the market except for the cases where the products are still being developed (noted as *) or registered (noted as #).

Figure 2.

Number of cases of innovations in bio-inputs reported by the interviewed companies. Source: Interviews with companies’ representatives. Note: Innovations listed in the figure are available in the market except for the cases where the products are still being developed (noted as *) or registered (noted as #).

Figure 3.

Cluster analysis of innovations developed by interviewed companies in Argentina and Brazil. The two main formed groups are in different colors.

Figure 3.

Cluster analysis of innovations developed by interviewed companies in Argentina and Brazil. The two main formed groups are in different colors.

Figure 4.

Summary of ongoing innovation fronts in agricultural bio-inputs taking place in Argentina and Brazil.

Figure 4.

Summary of ongoing innovation fronts in agricultural bio-inputs taking place in Argentina and Brazil.

Table 1.

Interviewed companies and their webpages.

Table 1.

Interviewed companies and their webpages.

Table 2.

Generations of technological developments in bio-products in Argentina and Brazil.

Table 2.

Generations of technological developments in bio-products in Argentina and Brazil.

| Generation | Uses (Most Common) | Characteristics | Active Ingredients (Most Common) | Main Technological Development |

|---|---|---|---|---|

| First | Inoculants to promote nitrogen-fixing by plants | Isolated conventional bacteria | Bradyrhizobium japonicum | Isolating, growing, and preventing contamination |

| Second | Bio-fertilizers for plant growth and nutrient solubilization | Non-conventional PGPR bacteria (isolated or in the pool) | Bacillus subtilis and Pseudomonas fluorescens | Keeping the stability and levels of different organisms over time |

| Third | Bio-pesticides for pest control | Pool of isolated, non-conventional bacteria, fungi, and viruses | Bacteria + fungus such as Trichoderma harzianun | Isolating spore-producing organisms and stabilizing the fungi |

| Fourth | Phytovaccines that activate plants’ immune systems | Molecular biology to produce recombinant proteins, peptides, and ribonucleic acid (RNA) | Bio-elicitors made of pathogenic fungi or bacteria | Know-how in molecular biology and industrial processes |

Table 3.

Examples of state-of-the-art technologies of the main types of bio-inputs that are either available in the market or are under development in Argentina and Brazil (name of the commercial product and description).

Table 3.

Examples of state-of-the-art technologies of the main types of bio-inputs that are either available in the market or are under development in Argentina and Brazil (name of the commercial product and description).

| Use | Company | Developments in the Market | Ongoing Developments |

|---|---|---|---|

| Inoculants | Rizobacter | Rizoliq—Bradyrhizobium sp. in high concentration in the container and on the seed | Rizoliq Dakar—Bradyrhizobium japonicum and Bradyrhizobium diazoefficiens for better biological fixation in environments of water deficiency and high temperatures |

| Biagro (Go Exper) | Biagro N2 with Azospirillum brasilense for grasses and Biagro Beans with Rhizobium tropici for beans | Liquid and peaty (turfoso) inoculants for 21 days of pre-inoculation | |

| Bio-fertilizers | Fragaria | Acqua Duo—Azospirillum brasiliense and Pseudomonas rhodesiae as a PGPR and P solubilizer | Bio-fertilizers based on Bacillus since it grows faster than conventional bacteria and has both PGPR and therapeutic effects |

| Moara | – | Bioprosolo (Registering)—Three species of Bacillus to solubilize P, stimulate root growth, and induce drought resistance | |

| Summabio | Summabalance and Summaroot (liquid humus + Isolated Pseudomona and Bacillus + micronutrients) | Include Trichoderma in the platform | |

| Bio-pesticides | Microvidas | Trichovidas—Trichoderma harzianum as a bio-fungicide | Studying the potential of lyophilization for having solid instead of liquid products (focusing on Trichoderma) |

| Biotrop | Fungicides Bombardeiro and Biomagno, nematicide Furatrop, and insecticides Biokato and Olimpo | Solid bio-pesticides (Olimpo, the first commercial product) | |

| Vital Force | Insecticide BioScap Liq based on Beauveria bassiana and Metarhizium anisopliae | Bio-nematicides and plant resistance induction | |

| Phytovaccines | Protergium | Phytovaccine based on recombinant proteins—Products of the molecular biology platform registered as two bio-conditioners, one for soybeans and the other for cereals | Phytovaccine based on RNA interference (developing) |

| Ceres Demeter | – | Metabolite of Streptomyces recombinant | |

| Other—Priming | Vittia | Priming—Bio-Immune has endospores that induce plant resistance | Gene silencing in specific microorganisms and investments to increase the portfolio of macro-organisms |

| Livestock feeding | Forbio | – | Inoculant Forsilo made of Lactobacillus plantarum to accelerate the anaerobic fermentation of silage to improve the quality of the feed offered to cows |

| Nano | Krilltech | Arbolina, which is based on organic carbon nanoparticles | Exploring possibilities to combine microorganisms and organic nanoparticles |

| Enzymes | Nova | Enzymes Xilanasa and Fitasa used to improve livestock digestion | Peptides from bacterial fermentation to be used as biofungicides |

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

[ad_2]