Optimal Operation and Market Integration of a Hybrid Farm with Green Hydrogen and Energy Storage: A Stochastic Approach Considering Wind and Electricity Price Uncertainties

[ad_1]

1. Introduction

These devices conform a system that can participate in both electricity and hydrogen markets. Modeling techniques should accurately address the components of such a system. Moreover, their control strategies need to take into account uncertainties caused by renewable sources and electricity price variability. Addressing these aspects has the potential to enhance the system’s profitability.

The aforementioned models are often incorporated into an optimization program with an objective function that governs the system’s techno-economic goals. This optimization program may be linear or nonlinear depending on the chosen formulations. It is called stochastic if uncertainties are considered and deterministic if they are not.

In this paper, a simulation framework of a hybrid farm (HF) consisting of a wind turbine coupled with an ESS and an AEL is developed. The HF participates in the hydrogen and day-ahead electricity markets. This framework is used in different case studies with historical data in order to obtain insights into future hydrogen market and supply chain scenarios and into their influence on optimal plant configurations.

The model presented here is formulated as a mixed-integer linear program (MILP), which is well-suited for control simulations; hence, this approach is considered in this work. A new AEL model is presented, addressing partial load degradation or oxygen contamination, which is something not previously addressed in the literature.

A progressive optimization model for day-ahead market bidding and real-time operation is proposed. The use of bootstrap sampling in the second-stage costs is proposed. This approach allows for a more robust evaluation of the candidates’ solutions using the same data. Results show how this technique yields a better outcome than the most common Monte Carlo simulation approach. The proposed technique outperforms Monte Carlo simulation methods from the literature.

The contributions of this work can be summarized as follows:

-

A simple but accurate linear AEL model is proposed, including degradation mechanisms and partial load effects for power system simulations and optimization, which tend to be neglected in the literature.

-

A stochastic optimization algorithm is presented for day-ahead electricity market scheduling to deal with price and renewable production uncertainties, which outperforms existing stochastic and deterministic approaches while using the same input data.

-

The presented model is used in a simulation framework for studying future hydrogen market and supply chain scenarios and their effect on hybrid plant configurations. This analysis highlights the practical applications of the proposed model.

2. Plant Components Modeling

In this section, the mathematical formulation of the battery energy storage system (BESS) and AEL models is presented. These models are subsequently integrated into an HF and coordinated with a wind turbine. The resulting HF is connected to the grid, enabling electricity market participation.

The physical characteristics of the components are formulated as mixed-integer linear program constraints. This is a powerful mathematical tool that enables the integration of discrete decision variables. These discrete variables are well-suited for modeling the charging/discharging states of a BESS or the operational stages of an AEL. Furthermore, linear optimization is robust and well-suited for large-scale simulations.

The section progresses by first introducing the mathematical formulation of the BESS model, followed by the AEL model, and concluding with the introduction of the plant model.

2.1. Battery Energy Storage System

The purpose of a BESS within an HF is to store energy generated by the renewable source for later use. This stored energy can be traded on the market when prices are favorable or utilized to compensate for deviations in energy generation. The integration of a BESS into an HF provides increased flexibility in renewable generator operation.

The input variable for these models is the charge/discharge power over a specific time period. It is assumed that such power is constant throughout the period.

where SOH is the state of health in per unit (pu), is the currently available capacity, and is the nominal capacity, both in MWh.

The optimization problem’s constraints delimit the solution space to the physical limitations of the device. These constraints are as follows:

-

The BESS cannot be charged above its nominal power, as represented by the equation

where

is the charging power during hour t in MW, is the nominal power in MW, and ND(t) is a boolean variable that is equal to 1 when the BESS is not discharging at time t.

-

The BESS cannot discharge above its nominal power, as represented by the equation

where

is the discharging power during hour t in MW, is the nominal power in MW, and NC(t) is a boolean variable that is equal to 1 when the BESS is not charging at time t.

-

Charging power is always positive, as represented by the equation

-

Discharging power is also always positive, as represented by the equation

-

The BESS cannot be charged and discharged simultaneously, as represented by the equation

-

The resulting BESS power at period t is computed for convenience as

-

The energy stored at the end of the period equals the amount stored at the end of the previous hour and the charged/discharged energy considering efficiencies, as represented by the equation

ξ D i s , where E(t) is the stored energy at the end of hour t in MWh, is the charging efficiency as a percentage, and is the discharging efficiency as a percentage.

-

The SOC at any given time must be between the boundaries and .

-

The SOC at , , is set by the user for the first day of simulation, but it inherits its value from the final value of the previous day for multiple-day simulations.

-

The BESS daily degradation cost is computed as follows:

where is the daily BESS degradation cost in EUR, and is the BESS replacement cost in EUR. The use of for computing a cost from battery degradation creates an optimization problem for amortizing a future BESS replacement.

2.2. Alkaline Electrolyzer

where:

-

: AEL remaining useful lifetime t (pu);

-

Hours(t): Hours of operation during time period t;

-

: Lifetime hours;

-

Cycles(t): Start/stop cycles performed during time period t;

-

: Start/stop lifetime cycles.

where:

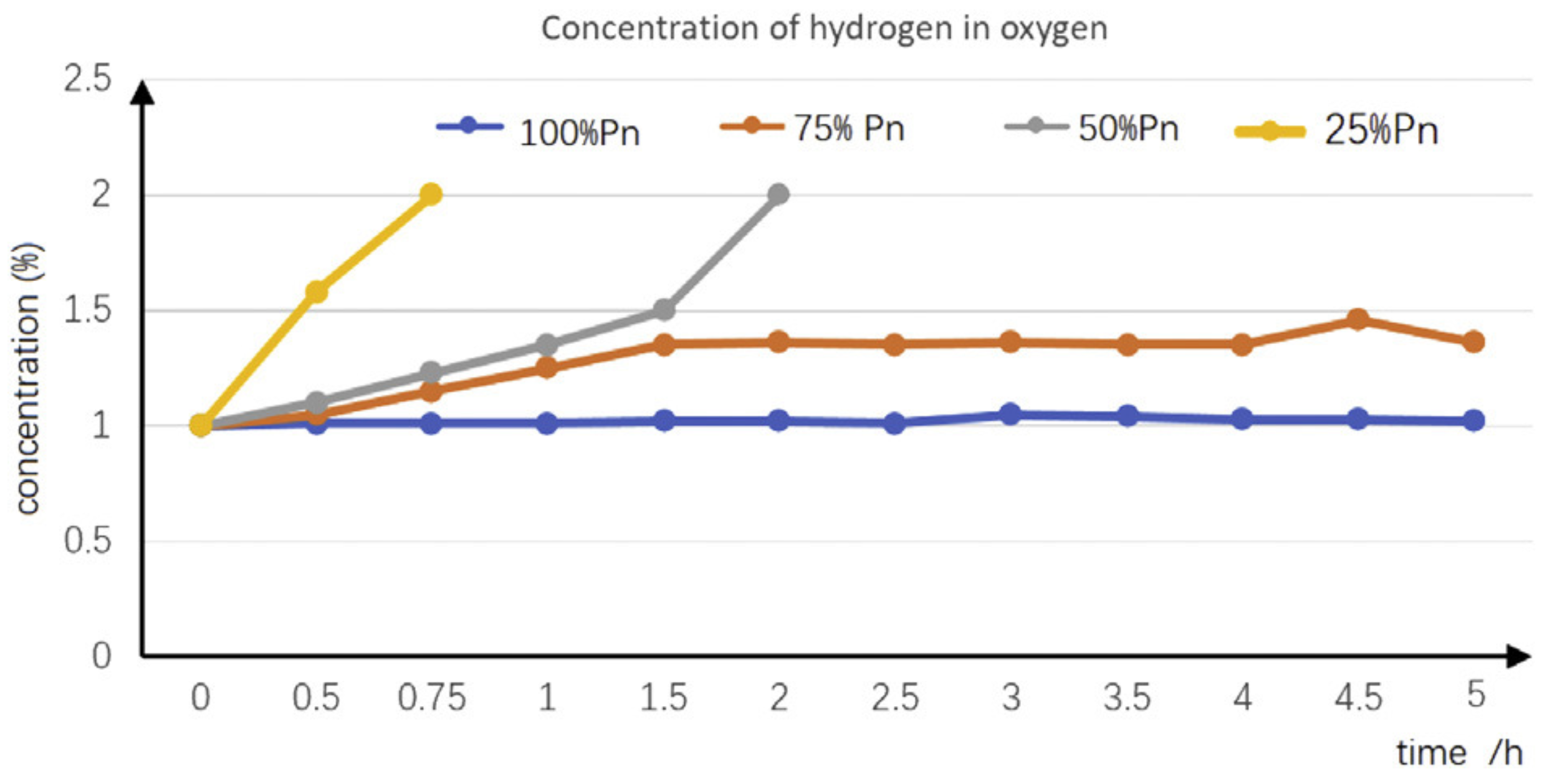

Relationship between oxygen contamination and active power [31].

Relationship between oxygen contamination and active power [31].

-

On mode: The AEL is producing hydrogen and operating at nominal conditions.

-

Idle mode: Nominal conditions are maintained, but the AEL is not producing hydrogen.

-

Off mode: The AEL is not generating hydrogen, and no energy is being applied to maintain nominal conditions, resulting in a gradual cooling until reaching a fully cold state.

As with the BESS model, the optimization constraints align with the physical limitations of the device, limiting the solution space. These constraints are outlined as follows:

-

The total electrolyzer power output for each time period is derived from the sum of the various operating modes:

where is the power employed in producing hydrogen during hour t in MW, is the power consumed in the Idle mode during hour t in MW, is the cold starting power consumed during time period t in MW, and is the total power consumption during hour t in MW.

-

Binary variables are used to determine the AEL operation mode at each hour, and only one mode is allowed at a time:

where

is the binary variable for On mode,

is the binary variable for Off mode, and

is the binary variable for Idle mode. Each binary variable takes value 1 when its respective mode is enabled.

-

An additional mode is used to define the cooling process, which appears only when the AEL is off:

where is a binary variable that defines Cool mode, in which AEL temperature and pressure slowly decrease since it is shut down. It equals 1 when its temperature and pressure state has become colder.

-

The pressure and temperature state of the electrolyzer is updated at each hour as follows:

where is the state at the end of hour t; this variable is limited between 0 and . The variable is the number of hours it takes to get fully cold when off, and is the fraction of the starting power required for a cold start.

-

Whenever the electrolyzer is off, its temperature and pressure decrease until they reach the fully cold state:

C o o l ( t ) ≥ τ t − 1 t o f f − 1 + π o f f ( t ) , where the value 1 in the first term prevents the binary variable from reaching a value of 0 until is 0.

-

Idle mode’s hourly power consumption is defined as:

where is the hourly power consumption during Idle mode in MW.

-

On mode’s hourly power consumption is limited as:

where and are the minimum and maximum AEL On mode’s active powers, respectively, in MW.

-

The cold start power factor is defined as:

t o f f . This factor, bounded between 0 and 1, represents how far the AEL is from reaching an operational state. If 1, it needs the full cold start power.

-

The cold start power consumption is defined as:

where is the AEL starting power in MW, is the cold start time in hours, and is the maximum electrolyzer power in MW. This equation models the starting power consumption and considers that less power is required if the AEL is not completely cold when a cold start takes place.

-

The hydrogen generation process is defined as:

where is the hydrogen flow during hour t in kg, is the AEL efficiency in pu, and is the hydrogen high heating value in kg/MWh.

-

The operation cost of the AEL, defined by the degradation models described above, is formulated as:

E O L h o u r s + π o f f ( t − 1 ) + π o n ( t ) + π i d l e ( t ) − 1 E O L c y c l e s · K , where

is the degradation cost during hour t in EUR, and K is the electrolyzer replacement cost in EUR. The first term of the sum represents the degradation caused by operational hours of usage, and the second term is the degradation caused by on/off operational cycles.

-

The oxygen contamination process is formulated as:

where is the oxygen impurity level at the end of hour t in %, is the oxygen contamination during hour t in %, and is a binary variable that defines the AEL purging.

-

The Purging mode is enabled when no is being produced:

An inequality constraint is applied to allow for the possibility of Off and Idle modes to be non-zero when no purge is in progress. This scenario occurs, for instance, when the AEL is in a clean state and does not intend to generate hydrogen, enabling the Off or Idle binary variables to have a value of 1.

-

When oxygen contamination reaches 2%, the AEL is shut down:

-

Purging mode is disabled when the contamination value reaches 0:

-

A piecewise constraint is used to regulate the contamination process, derived from (12):

< 0.3 3.5 − 5 · P o n ( t ) A E L P m a x if 0.3 ≤ P o n ( t ) A E L P m a x ≤ 0.7 0 if P o n ( t ) A E L P m a x > 0.7 .

2.3. Plant Model

The system operates within the hydrogen and electricity markets. Energy generated by the wind turbine can be sent to the AEL, the BESS, and the grid. The BESS can supply energy to both the AEL and the grid. The AEL can receive energy from all other agents.

These additional constraints are used to determine the aforementioned interactions. Active powers during each hourly period are considered constant; thus, active power can be treated as energy. These constraints are defined as follows:

-

The power generated by the wind farm is defined as:

where is the generated power during hour t in MW,

is the generated power used by the BESS during hour t in MW,

is the generated power sent to the grid during hour t,

is the generated power sent to the AEL during hour t in MW, and

is the curtailed power during hour t in MW.

-

The BESS discharging power is divided as follows:

where is the BESS power sent to the grid during hour t in MW, and is the BESS power sent to the AEL during hour t.

-

The AEL power flow is defined as follows:

3. Mathematical Programming Models for Day-Ahead Market Bidding and Real-Time Control

In this section, the formulations of the objective functions of both models are introduced. As an example, the operation for a single day is shown. In this work, Cbc solver has been used in the optimization algorithm with a tolerance of .

3.1. Day-Ahead Market Bidding

where is the hourly forecasted electricity price in EUR/MWh, and is the hydrogen price in EUR/kg. As can be seen, the objective function has two terms: one for the operation in the electricity market and the other for the operation in the hydrogen market.

3.2. Real-Time Operation

where is the day-ahead market power commitment for hour t in MW, is the real electricity price for hour t in EUR/MWh, and is the deviation cost factor for hour t. The objective function of this optimization problem is formulated as follows:

The primary objective at this stage is to optimize profits through the implementation of measures aimed at minimizing deviation costs and utilizing surplus energy for the production of hydrogen.

4. Two-Stage Stochastic Optimization Algorithm

A two-stage stochastic problem is developed using the aforementioned optimization models. This section provides an overview of these stochastic algorithms and their application. The standard Monte Carlo simulation approach is presented. Afterwards, an algorithm based on bootstrap sampling is proposed.

4.1. Two-Stage Stochastic Optimization Overview

Then, the outcome of the candidate solution is evaluated in the second stage. At this stage, the cost of the decisions made in the first are computed using the realization of the uncertain parameters. The best solution is evaluated using both the expected benefits in the first stage and the cost in the second one. The optimization model aims to reduce the cost of the second-stage decisions while selecting the candidate solution with the highest first-stage benefits.

4.2. Monte Carlo Approach

For each combination of scenarios, a candidate solution is generated using the day-ahead optimization model. Therefore, in the first stage, 100 candidate solutions are generated. The power commitments of each candidate solution are sent to the real-time optimization model.

where represents the second-stage costs under wind speed scenario j and electricity price scenario i for candidate solution x in EUR.

are the deviation costs in EUR, and

is the difference between expected and real electricity market benefits in EUR.

where

are the expected benefits for candidate solution S in EUR, and is the conditional value-at-risk of the second-stage costs for candidate solution S in EUR for the confidence interval , which has been set to 95%, a common choice in stochastic problems.

The current implementation faces a challenge in regards to increasing the number of available samples. Each sample requires solving an additional optimization problem, and therefore, for 100 candidate solutions, 10,000 optimization problems must be solved for each day. This can result in the requirement to solve one million optimization problems in order to obtain 1000 samples for 1000 candidate solutions, which may render the problem computationally infeasible due to the amount of computational time required, especially considering that this model runs online.

4.3. Bootstrapping Approach

This method involves re-sampling the original population randomly, thereby generating a new sample. A statistical quantity of the new sample is calculated, such as the mean. By repeating this process, a distribution of estimates is obtained, which can be used to calculate variability measures.

Bootstrapping is often computationally simpler than Monte Carlo. Additionally, it can provide more accurate estimates when the sample size is small or the distribution is not normal. Also, obtaining a confidence interval of a statistical quantity allows for a more robust approach with a smaller population of samples.

where is the conditional value-at-risk of the second-stage cost means for candidate solution S in EUR for the confidence interval . A 95% confidence interval is used in this case.

5. Simulation Framework and Results

A demonstration of the introduced model is presented in this section. Afterwards, the simulation framework for evaluating the performance of the proposed optimization method is described. Different simulation scenarios are run on the same plant model, and in each case, a different approach for generating day-ahead market commitments is considered. Results under each approach are presented and compared. The key performance indicators considered are the earnings for both electricity and hydrogen markets.

5.1. Single-Day Demonstration

This subsection presents a demonstration of the formulated plant model operation for 25 March 2020. The demonstration employs a deterministic forecast of electricity prices and generated power as input for the day-ahead stage. The power commitments are subsequently input into the real-time optimization problem, the primary objective of which is to minimize deviation resulting from forecasting errors.

The electrolyzer starts at full power later in the first hour by taking cold start power from the grid and runs at full power all day. The battery schedules an arbitrage operation using the price spread. When electricity prices are low, some power generated from the wind turbine is sent to the electrolyzer for hydrogen production.

5.2. Case Studies

Different case studies are performed with the simulation framework. The simulation is run from 1 January 2020 to 31 December 2020. AEL and BESS states at the end of a day are considered as the initial state for the next one. For simplicity, perfect price and wind power foresight are assumed.

5.2.1. Hydrogen Price Effects on Market Participation

The figure shows that the hydrogen market benefits become noticeable only when hydrogen prices exceed 1.5 EUR per kg. As the hydrogen prices increase further, the plant starts to use more energy for hydrogen production and, as a result, the electricity market participation decreases. When the hydrogen price reaches 3.5 EUR/kg, the benefits from the hydrogen market surpass the ones from the electricity market. It is remarkable how the benefits of hydrogen market start to appear only after a certain threshold.

5.2.2. Hydrogen Price Effects on Different Hydrogen Off-Taker Scenarios

Results demonstrate how the pipeline scenario yields the best results. Increasing tank unloading regularity permits operating with smaller tanks. This constraint needs to be carefully considered when sizing the plant in order to obtain the best balance between unloading schedule and tank capacity. This requirement is present in both low-price and high-price scenarios; however, the presence of a pipeline clearly demonstrates better results in any case.

5.2.3. Hydrogen Price Effects Depending on AEL Grid Connections

Results indicate that, at low hydrogen prices, enabling hydrogen market participation increases plant outcome only when the AEL is disconnected from the grid. AEL interaction with the electricity market only yields better results when hydrogen prices approach 3 EUR/kg, indicating that only high hydrogen prices justify the connection to the grid.

5.3. Stochastic Algorithm Comparison

Four different simulation scenarios are considered:

-

Ideal scenario: The plant receives perfect wind speed and electricity price forecasts.

-

Stochastic Monte Carlo scenario: The Monte Carlo algorithm is used for day-ahead commitment generation.

-

Stochastic Bootstrap scenario: The proposed bootstrap algorithm is used for day-ahead commitment generation.

-

Deterministic scenario: A direct approach that considers deterministic forecasts.

The Deterministic method of utilizing direct predictions surpasses the utilization of the conventional Monte Carlo technique. This can be caused by the low amount of available scenarios. The strategy that has been proposed, incorporating bootstrap sampling, demonstrates superior results compared to both the Monte Carlo and Deterministic approaches.

6. Conclusions and Future Work

A mathematical optimization model has been proposed for the integration of an AEL, a BESS, and a wind turbine generator. This model takes into account the effect of partial loading into the AEL oxygen phase, as well as the degradation effects for both the AEL and the BESS. A linear formulation has been proposed to ensure its efficiency in EMS optimization applications.

The effect of wind speed and energy price uncertainties has been addressed with the proposal of a two-stage stochastic optimization model. The state-of-the-art Monte Carlo approach has been compared to a novel bootstrap-based algorithm. A simulation framework has been developed to evaluate the performance of the proposed algorithm.

A comparison between a classical Monte Carlo approach and the proposed bootstrapping implementation demonstrates how this algorithm yields a better outcome than the use of a Monte Carlo strategy using the same data. This can be useful for online applications, in which computational time is a constraint for continuous operation.

Case studies of different plant configurations and hydrogen supply chain structures have been studied. Results demonstrate how, at low hydrogen prices, plant configuration must be carefully addressed in order to obtain optimal income. Moreover, AEL interactions with the electrical market are detrimental at low hydrogen prices.

In future work, the authors propose an extension of this algorithm for intra-day market participation. The BESS participation in frequency response services is also suggested. Also, it is considered that some limitations, such as testing longer time frames or different electricity markets, could be considered for future research.

[ad_2]